Targets and Incentives

Summary for Decision Makers

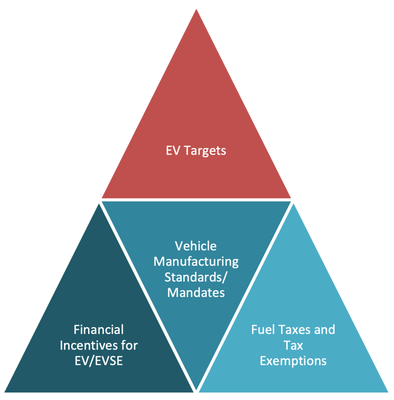

There are a variety of targets and incentives that can be considered to accelerate EV market development

The type of benefits a government seeks from EV deployment and its existing EV goals, targets, and objectives influence the prioritization and selection of policies, targets, and incentives. Decision makers can:

- Set EV and EVSE targets, as these commitments can focus and guide government and private sector deployment strategies.

- Consider EV and EVSE purchase incentives to help defray the capital costs of these important investments.

- Consider “soft cost” incentives, such as free parking or reduced registration fees, that reduce total cost of ownership for EVs.

- Pair EV incentives with disincentives for ICE use, such as fuel or GHG taxes.

- Increase the supply of EVs through standards and mandates that require manufacturers to develop more fuel-efficient, low-emissions products such as EVs.

- Develop consumer education and awareness programs to build end-user demand for EVs.

What Are EV and Electric Vehicle Supply Equipment (EVSE) Targets?

EV deployment targets set a vision and concrete objective for EV market development in each jurisdiction. EV targets can be understood as a policy goal, rather than a specific policy instrument. Though not a prerequisite for market development, EV targets can offer a useful long-term vision for policy and regulatory authorities, as well as industry, who are planning to take actions to increase EV adoption. EV targets are typically specified on a sales and/or cumulative stock basis for different types of vehicles. Electric vehicle supply equipment (EVSE) targets primarily focus on publicly available charging stations to incentivize EV infrastructure readiness and meet demands of EV owners.

EV Sales Target: Defined as an absolute number of EV sales or percentage of total car sales that are EVs specified over a defined period. Sales targets can be set by governments at any level, from national or provincial to state or local. One key design dimension of EV sales targets is eligibility, with decision makers needing to decide which specific EV technologies and applications (e.g., light duty, buses, trucks, etc.) should count toward target achievement.

EV Stock Target: EV stock targets are defined aspirations for the total number of registered vehicles on the road that are electric. Like EV sales targets, EV stock targets require consideration of eligible technologies, vehicle applications (e.g., light-duty vehicles, buses, etc.), and timeframes for target achievement.

What Are Purchase Incentives?

Purchase incentives are used to reduce upfront purchase costs of EVs. In practice, the most easily managed purchase incentives can take the form of reduced import duties, registration fees, or sales taxes. Other purchase incentives include cash grants, rebates, tax incentives, and/or low-interest financing. They typically feature eligibility criteria based on aspects such as: EV technology type, cumulative sales of specific EV models, program expenditure caps, and other elements. EVSE subsidies involve financial support for charging infrastructure deployment and installment.

Soft Cost Incentives: Soft cost incentives are indirect financial benefits that reduce total cost of ownership for EVs. Distinct from purchase incentives, they can include favorable benefits such as free or priority parking, reduction or elimination of vehicle registration fees, and special access to toll roads or high-occupancy vehicle lanes for EV owners.

Disincentives for Conventional Vehicle Use: While direct and soft cost financial incentives provide an incentive for adopting EVs, governments can also use employ methods to discourage the use of conventional vehicles. Two common ways of doing so are through fuel taxes and emissions taxes. Fuel taxes are a type of excise tax that is imposed on the sale of fuel. Fuel taxes are eliminated or unnecessary for EV owners, as the vehicles are refueled through electricity. In addition, vehicle emissions taxes are common in European countries; over 18 European countries have CO2 emission taxes. The CO2 emission taxes are based on the vehicle and CO2 emitted (g/km).

What Are Standards and Mandates?

Vehicle manufacturing standards require automotive manufacturers to ensure the vehicles they produce meet specific requirements, including minimum fuel economy levels and greenhouse gas (GHG) emission intensity levels. Manufacturing standards typically apply to manufacturers of internal combustion engine (ICE) vehicles. The manufacturing and sale of EVs, however, is often used to comply with these standards by increasing fleet-wide fuel economy and decreasing fleet-wide GHG intensity.

Fuel Economy Standards and GHG Emission Standards: Fuel economy standards incentivize vehicle manufacturers to develop and produce vehicles that can travel further using less fuel, thereby reducing gasoline/diesel consumption and GHG emissions. Because EVs use no gasoline, they can greatly improve the average fuel economy (in km per L gasoline) of the manufacturer’s fleet.

ZEV Mandate: A ZEV mandate requires vehicle manufacturers to incorporate more ZEVs in the market. ZEV type or eligibility is one of the program’s design dimension, as the term for ZEV can vary by region. ZEV is generally defined as a vehicle or car that does not produce tailpipe exhaust. Because they do not produce tailpipe emissions, EVs (of various types) are considered ZEVs and can help vehicle manufacturers meet their ZEV requirements. The design dimensions of the ZEV mandate includes vehicle manufacturer volume size based on sales, ZEV eligibility based on vehicle type, credit requirements and credit value based on vehicle type, and mandate penalties. Within a ZEV program, vehicle manufacturers are assigned ZEV credit requirement that are earned by selling ZEVs (i.e., the number of credits are based on ZEV type). Based on the credit requirement, a certain percentage of sales must be ZEVs.

What Are Fossil Fuel Taxes?

Fossil fuel (excise) taxes are collected at the time of vehicle refueling for gasoline-fueled vehicles and are often used to fund road construction and repair. EVs do not directly use gasoline or diesel, and thus are not required to pay fuel taxes. For some EV owners, this can be viewed as an incentive to purchase EVs over conventional vehicles, in addition to the already cheaper cost of electricity as a transportation fuel relative to gasoline or diesel.

Why Is Consumer Education and Awareness Important?

Consumer education and awareness drive end-use EV adoption and are key aspects of EV market transformation. While many government agencies and ministries are incorporating and implementing EV targets and incentives to increase EV adoption, it is crucial to communicate, educate, and establish awareness of EV technologies, policies, and incentives to consumers. Developing local communication programs or joining global programs can provide a platform to promote EVs to consumers and communities. Resources developed can be implemented into local communication programs, discussed at public events and workshops, and shared through social media marketing. Clear, tailored consumer education and awareness initiatives encourage EV adoption beyond early adopters and help mainstream the technology.

Additional Resources

Effectiveness of Electric Vehicle Policies and Implications for Pakistan (Hodge, O’Neill, Coney 2020)

Comparison of Leading Electric Vehicle Policy and Deployment in Europe (Tietge et al. 2016)

The Role of Demand-Side Incentives and Charging Infrastructure on Plug-In Electric Vehicle Adoption: Analysis of U.S. States (Easwaran Narassimhan and Caley Johnson 2018)

Greening the Grid Electric Vehicle Toolkit: Policy and Regulation Page (NREL 2021)